Customized Insurance Programs & Employee Benefit Plans For Members

Member Group Rated (Pooled) Plans

Offer your membership group priced products that allow individual members, spouses, and member’s employees to participate in a plan with large group type benefits and large group rates exclusively designed for association/affinity group members. These plans utilize the buying power of Member Benefits’ collective association member client base, are proprietary, and not available to the general public.

Premium Discounts, Underwriting Concessions, and Product Enhancements

Member Benefits negotiates exclusive endorsement arrangements for discounted pricing with various product and service providers. Members will have access to special pricing, underwriting concessions, and product enhancements.

Association Health Plans

Member Benefits can create an exclusive membership-based health plan option for your members. Rather than benefiting the stockholders of a typical publicly traded health insurance company, profits go back into the plan to offset future renewals or potentially issue future refunds to the policyholders. These are also sometimes referred to as association group health plans, captives, multiple employer welfare arrangement (MEWA), consortium plans (depending on state regulations and availability), and level-funded association health programs.

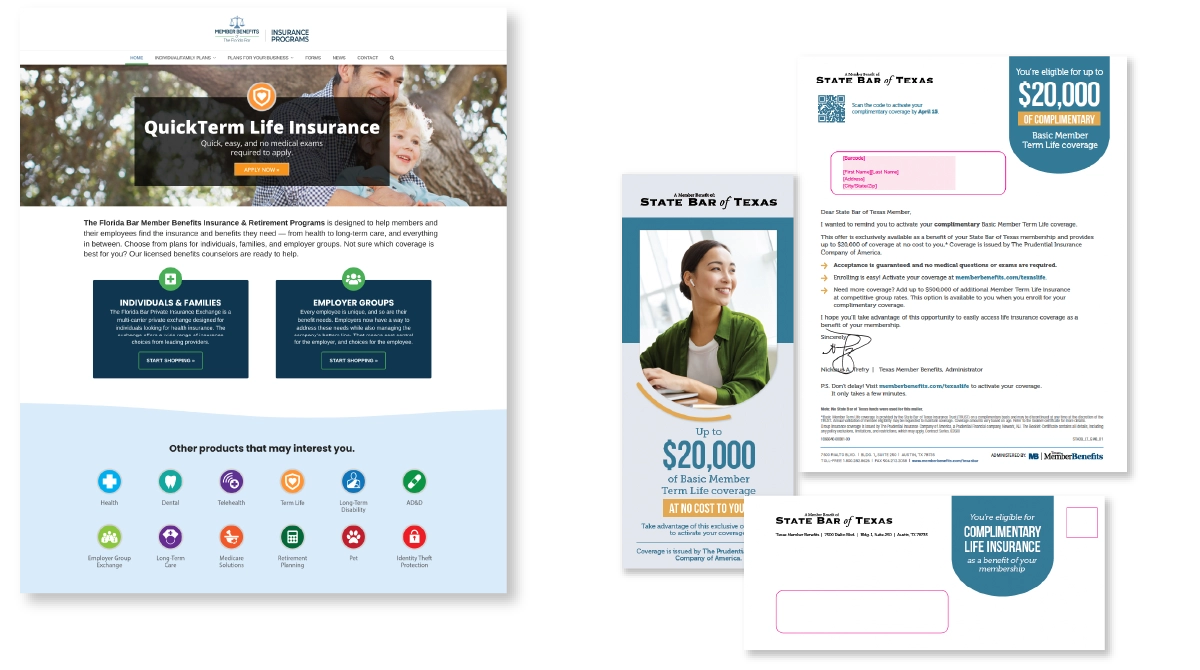

E-Commerce Insurance Shopping Solutions

Member Benefits offers a premier level web-based shopping experience backed by experienced benefits counselors who provide guidance and assistance to members during the insurance procurement process and throughout the plan year as members use their coverage.

Key differentiators of Member Benefits’ Private Exchange solutions include:

- Multiple health insurance carrier platforms

- Government subsidy eligibility assistance

- Robust defined-contribution features for employers

- Industry-leading consumer-directed accounts platform

- Specially priced ancillary association group products

- Association member level service model

The exchange offering is divided into two different components: the Individual Exchange; and the Employer Group Exchange.

Individual Marketplace

The Individual Marketplace provides individuals (members and/or employees) with an online shopping experience that enables members to select from multiple leading health insurance providers, as well as valuable ancillary benefits such as dental, vision and more. Individuals create and manage their own individual benefits portfolio online.

Employer Group Enrollment & HR Administration Technology

We’ll build your membership a customized online marketplace where members, and their employees, can compare and purchase products and services from insurance and benefit providers that compete for business within the exchange.

Our custom employer enrollment technology solutions provide a comprehensive benefits management platform. Employers create their own white-labeled employee portal and choose from multiple insurance and carrier options. This model is designed around the strategy of shifting employers from the costly defined benefit insurance model to the defined contribution model, whereby employers can set, budget, and better control their benefits expenses. Employees use their “defined contribution” monies to shop from a wide variety of plans on the exchange.

Marketing & Communications

We’ve been testing and fine-tuning our communications strategies for decades. The result: a carefully crafted approach that maximizes awareness and satisfaction level among your members without overloading them with program information. We want your members to feel good about your association and have an appreciation for the benefits you’ve negotiated on their behalf.

Most product vendors only have their own marketing campaigns under consideration and have little knowledge of when and how often other vendors are sending communications to your members. Sending too many messages to your membership can eventually cause your Member Benefits Program to get watered down and lose its value.

With so many insurance and financial products that can benefit your members, a key advantage to associations offering a consolidated benefits program through a third-party administrator as opposed to directly through product vendors is our sensitivity to the communication schedule. Members don’t want to be bombarded with simultaneous mailers, emails, and solicitation calls. These communications need to be sent in a timely manner and the message needs to be consistent. Effective communication is a common factor in every successful Member Benefits program.

Our marketing communications focuses on the most effective channels for reaching your members, such as:

- Branded websites

- Email marketing

- Product-specific direct mail

- Print & digital advertising

- Social media

- Webinars