If you missed our 2025 Individual Health Insurance Open Enrollment webinar a video replay is…

Blue Cross Abandons Affordable Care Act Insurance Exchange in Missouri

UPDATE 6/13/2017:

St. Louis-based Insurance company, Centene Corp., has announced plans to enter the Missouri, Kansas, and Nevada Affordable Care Act insurance exchanges in 2018. In April of this year, Centene CEO Michael Neidorff was quoted as saying “As to exchanges, we see nothing at this point to prevent us from proceeding with our 2018 marketplace participation.

According to Kansas City Business Journal, “As of March 31st, Centene served about 1.2 million exchange members, up about 500,000 from the previous year.” Centene Corp. is also expected to expand its six current markets in Washington, Indiana, Ohio, Georgia, Florida, and Texas signaling the potential for even more growth in 2018.

In a statement, Neidorff said, “Centene recognizes there is uncertainty of new healthcare legislation, but we are well positioned to continue providing accessible, high quality and culturally sensitive healthcare services to our members” according to an article on Reuters.

Citing major and “unsustainable” financial losses, insurance giant Blue Cross Blue Shield have announced plans to abandon individual plans offered through the Affordable Care Act Insurance Exchange for 2018 in both Missouri and Kansas.

According to the press release, “Like many other health insurers across the country, we have been faced with challenges in this market. Through 2016, we have lost more than $100 million. This is unsustainable for our company. We have a responsibility to our members and the greater community to remain stable and secure, and the uncertain direction of this market is a barrier to our continued participation.”

This decision comes on the heels of Aetna’s recent decision to completely pull out of the insurance exchange program after a citing a $450 million financial loss in 2016 and an additional projected $200 million loss this year.

While Blue Cross has roughly 1 million members in the affected area, they are estimating that approximately 67,000 will lose coverage. The new decision will not impact members who purchased their plans prior to October 1st, 2013, those who purchased Medicare Advantage, Medicare Supplement, short-term or student health plan from Blue KC, or members who have Blue Cross coverage through their employer.

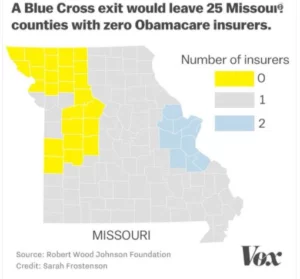

Nonetheless, the move by Blue Cross comes as a major blow to families and individuals in the area, not to mention the Affordable Care Act itself. Out of the 32 counties the decision impacts, 25 will be left without any options available on the exchange as the situation stands today. Insurance providers have until June 21st to inform the government where or if they will sell plans on the insurance exchanges for 2018.

The State of the ACA Insurance Exchange in Missouri

According to Fox4kc.com “This year, 97 out of Missouri’s 114 counties and the City of St. Louis have only one insurer offering plans on the exchanges. Earlier this year, Humana announced that it is also withdrawing from the exchanges. As things stand today, that leaves 25 counties with no insurer option and 77 counties with only one insurer option next year.

This comes on top of a new report from the Department of Health and Human Services showing that under Obamacare insurance premiums in Missouri’s individual market have increased by an astonishing 145% in just four years.”

Missouri isn’t the only state where insurance providers have been struggling. Healthcare Economist at Washington University in St. Louis, Tim McBride, believes the decision made by Blue Cross Blue Shield of Kansas City “is part of a larger trend with insurers pulling out of marketplaces in Virginia and Iowa as well.”

If you find yourself one of the 67,000 people in the Missouri and Kansas area that this decision impacts—we can help. For over 30 years, we have assisted thousands of employers and individuals secure the coverage they need for themselves and their families. Our benefits counselors are on hand M-F 8:30 am to 5:00 pm and are specially trained in helping attorneys with their insurance needs and may be able to help in the event of a loss of coverage for 2018.

Stay tuned to Member Benefits for more updates, or contact us today to see what options may be available to you.